Recently India was in the midst of a national-level debate where the burden of the military on the financials of the country was discussed. Passionate arguments were presented by numerous senior retired military Generals, who explained the changing world order and the emerging threats to the country. They presented various numbers and argued for an ever-increasing military budget with more equipment, manpower, and resources. Various values and numbers were floated in the evening prime-time news discussions. This made me curious so, I did what a Finance leader should do, look at the numbers holistically. My analysis should serve as an objective tool to look at the needs for national security vs economic and social growth priorities.

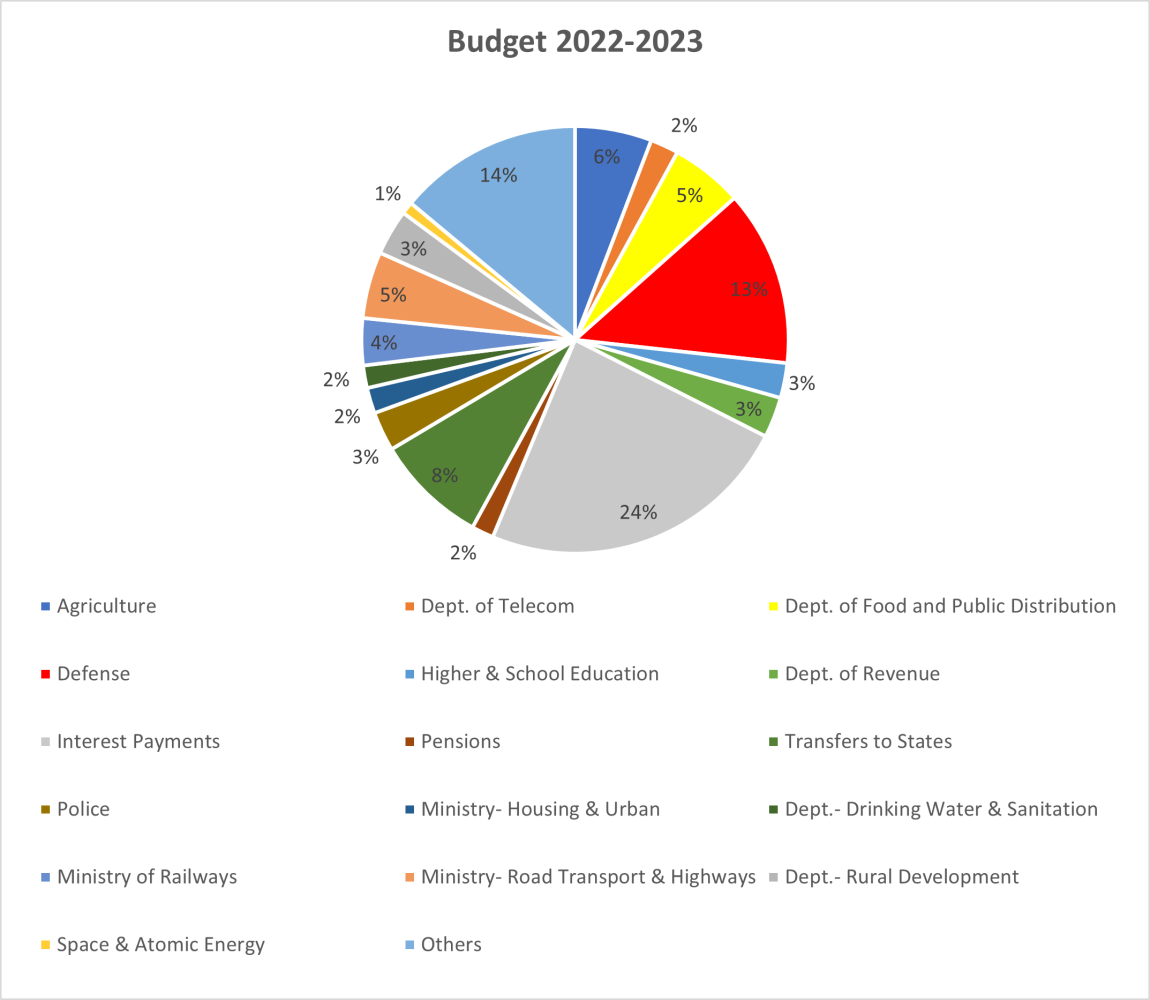

Looking at the current financial year’s budget FY22-23, the expenditure on Defense (13%) is the second biggest line item after Interest payment liabilities (24%). The expenditure is many times greater than what is spent on Education, Roads and Highways infrastructure, Housing, or Space technology. In a country of 1.4 billion people, each sector deserves increased allocation. The balancing act is the most complex art for budget allocation.

Secondly, looking at the pie itself, that is the revenue receipts of the government. Debt receipts (new debt) as a percentage of total receipts is 42% for the current fiscal year budget. This number was 52% in FY20-21, a year of unprecedented economic challenges. In this current scenario where the government has to borrow significantly every year to meet its expenditure obligations, seriously limits the capacity of the government to increase expenditure in any one category. Increased allocation for defense can only come by cutting share from another category.

The country is still reeling from the devastating economic effects of lockdowns in COVID. The economic effects would be long-term. Interest Payments of the expenditure was 19% in FY20-21 which is now 24% in FY22-23. This is because the government had to take more debt as its revenue fell during the pandemic. In my view, the economic recovery has been very quick due to the economic reforms taken by the government in streamlining the tax structure, such as GST. This resulted in revenue receipts increasing at a rate higher than the GDP growth. But now with another global economic downturn looming, the government has to prepare for a scenario of low growth.

India’s senior military leadership, especially retired Generals, routinely make statements to increase the defense budget to 3% of the GDP or the defense budget be doubled. After extensive analysis, I prepared a model with the scenario where India’s defense budget is increased by 50% for 3 years. The numbers below show the projections. The total debt will increase by 51%, the total debt to revenue receipts will increase from 6.9 to 8.3, and debt receipts would exceed the revenue receipts to 116% of the revenue receipts. The central government would take on more debt in three years than what it took in decades.

This increased financial burden would result in extremely strained financials for the country, high inflation, increased interest payments, and an economy that would not be able to weather the impending global recession. This is for a projected defense budget of $236B by FY25-26 from the current $70B. Which is still lower than the defense budget of China, India’s major security threat.

The tussle between the Military Generals and the Finance Department/National economic growth requirements is historical. In every annual budget cycle, we hear countless debates across every nation. At times, these discussions are not based on analysis or numbers or sometimes fictitious numbers, ignoring other priorities. I did the exercise to simulate the effect of a most talked about scenario with the hope that it helps in more informed discussions. A budget is a balancing act, a balancing of not only the needs of the country but also of the aspirations of the people. Hence the discussions especially by such senior leaders should be driven by numbers, security needs, and economic growth than emotionally biased.