Throughout history, government taxes have stood as enduring pillars, dating back thousands of years to the inception of organized governance. Across epochs, humanity has experimented with diverse tax structures, evolving alongside changing economies, governments, and cultures. The contemporary taxation system, a linchpin in the growth of the US economy over the past century, has played a pivotal role in securing the nation’s economic primacy. However, as we navigate present economic realities, the pressing question emerges: is our taxation system poised to weather the scrutiny of our times?

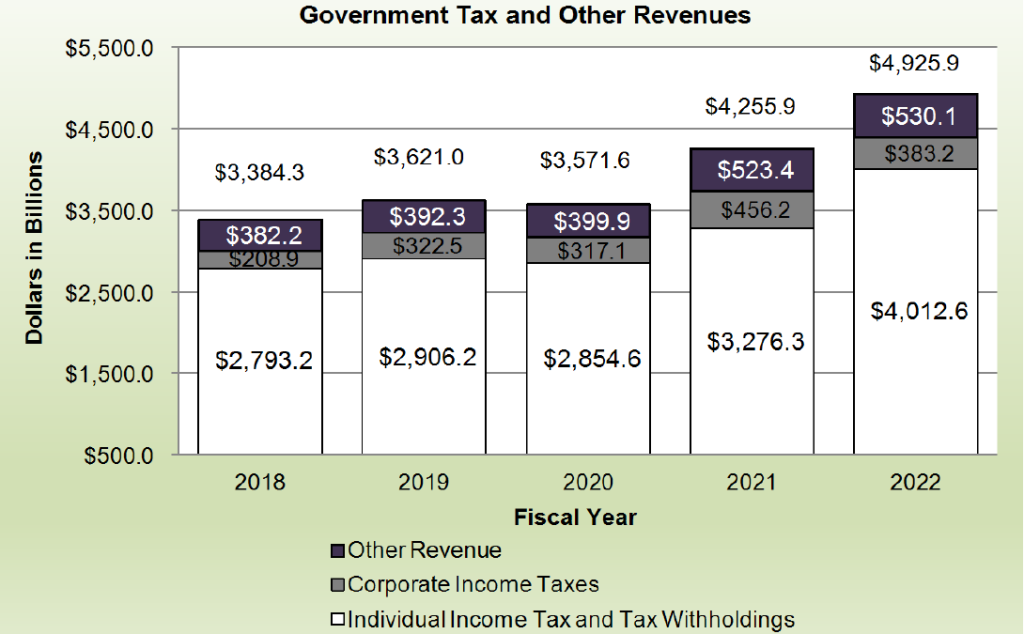

Over the last five years, government taxes and revenue collection have surged, predominantly borne by millions of individual taxpayers, constituting over 81% of total taxes in FY 22. Surprisingly, the lion’s share of the tax burden falls on the shoulders of individual taxpayers, far surpassing the contribution from corporate income taxes, which hovers around a modest 7%. This stark disparity places the burden on individual taxpayers well above the OECD average, highlighting a unique challenge faced by the American populace.

US FY 22 Financial Statement

The escalating burden on the taxpayer becomes evident when considering factors such as rising taxes, inflation and stagnant median household incomes. This compounding effect over the past five years necessitates a critical examination of the strain on individual taxpayers and prompts a reevaluation of our tax policies in light of contemporary economic dynamics.

Credit: Cbo.gov

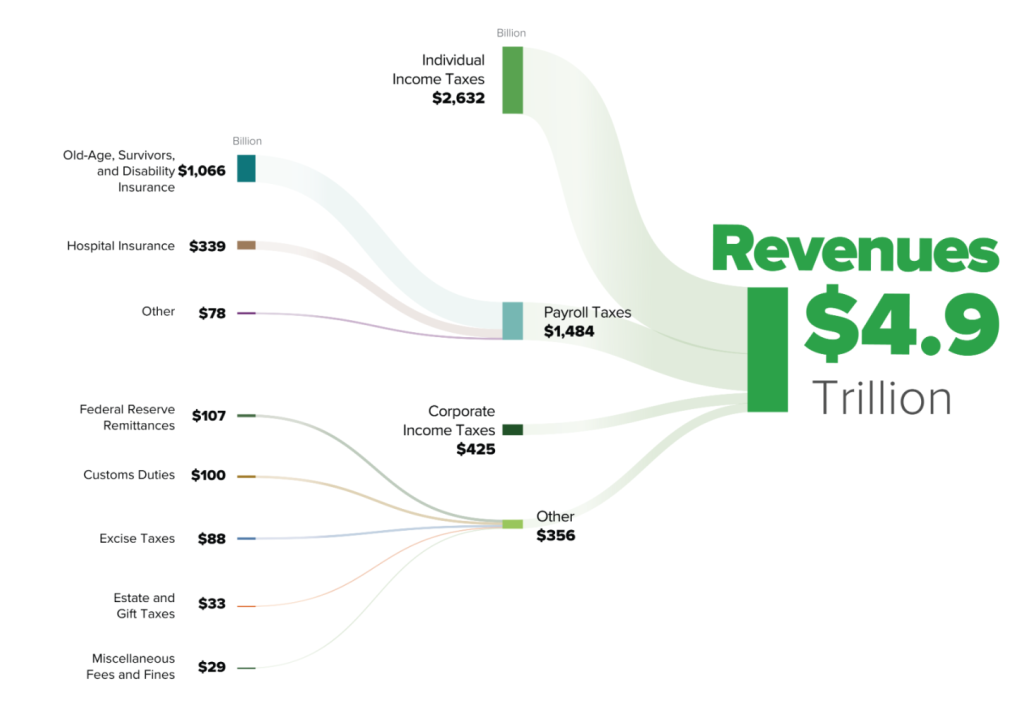

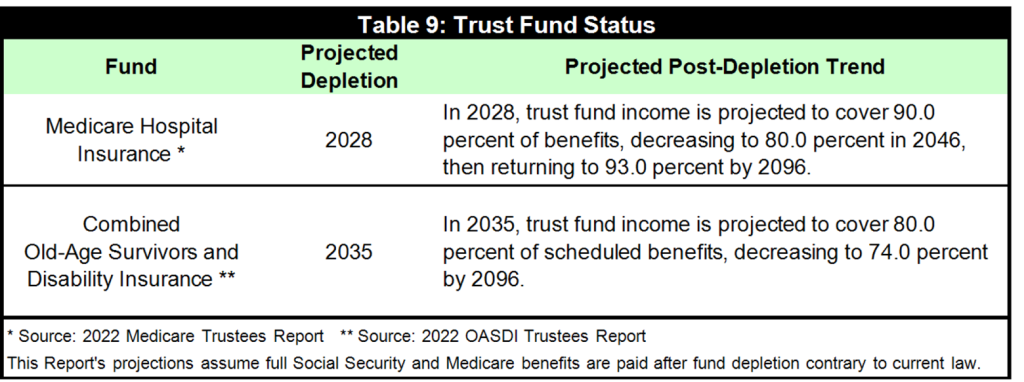

Delving into the numerical breakdown, individual taxpayers contributed a substantial $1,066 billion to old-age survivors and disability insurance, along with an additional $339 billion to medical insurance in 2022. Despite these substantial contributions, mismanagement by successive governments has cast a shadow over the sustainability of these funds, signaling a shortfall in the near future. This realization is disheartening for the average taxpayer who, throughout their life, contributes to these funds with the expectation of future security during retirement or in the event of disability. The looming threat of these funds being depleted not only undermines the faith of present taxpayers but also jeopardizes the rightful dues of future generations.

US FY 22 Finacial Statement

This predicament fosters a sense of disillusionment among taxpayers, eroding their motivation to contribute to the collective welfare of the nation. As the promise of future rewards diminishes, a wave of resentment sweeps through the population, breeding apathy towards the system. This, in turn, gives rise to heightened levels of corruption and tax avoidance, perpetuating a cycle of distrust and disengagement.

While acknowledging that taxes form the bedrock of any thriving economy, it is crucial to emphasize that these funds are a trust bestowed upon the government by its citizens. Taxes should not be viewed as personal coffers for politicians to fuel their individual ambitions. Numerous historical and contemporary examples underscore the catastrophic consequences of governments failing in their responsibility to strike the right balance in burdening their citizens, resulting in economic failure.

In light of these considerations, it is imperative for the government to adapt to the ever-evolving economic landscape and the needs of its people. A flexible and responsive approach to adjusting the tax structure is paramount, ensuring that it aligns with the dynamic realities of the country. Only through such adaptability can we foster a system where taxes are not seen as a burden to bear but as a collective investment in the well-being and prosperity of our nation.