“The US economy shrank at a 0.9% annual rate last quarter” and “European Central Bank Raises Rates for First Time in 11 Years” such news stories are daily occurrences in these unprecedented economic times. Looking at the past provides guidance for the future. Looking at the last global recession would provide guidance on the future as we move into another global recession. Eight economies, Australia, Canada, France, Germany, Italy, Japan, Spain, and UK constitute 23% of the global GDP even though they are just 6.6% of its population. These countries have been at the center of global economic and technological growth in the 20th century. I wanted to look at two periods, 1994 to 2007 and 2008 to 2021, a period before and after the great recession of 2008, as it would provide an insight into how these economies have fared during the recession. Looking at various metrics such as GDP, GDP per capita, debt, inflation, and exports, I wanted to analyze whether these countries can maintain their dominant position or if there would be challenges for these leaders as we move into another recession.

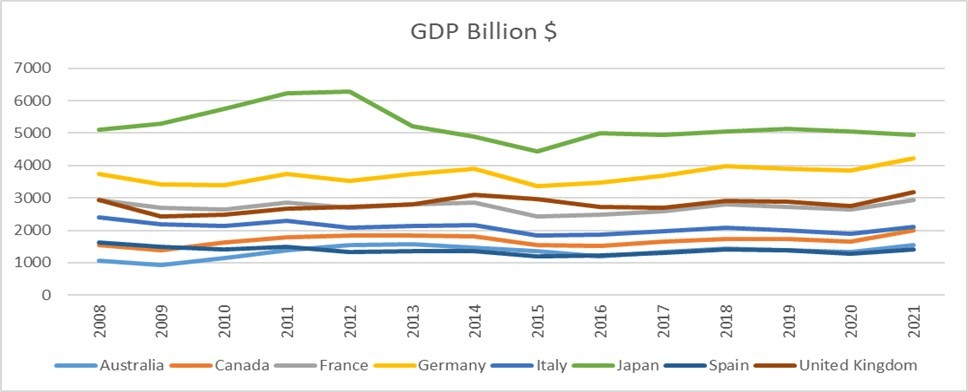

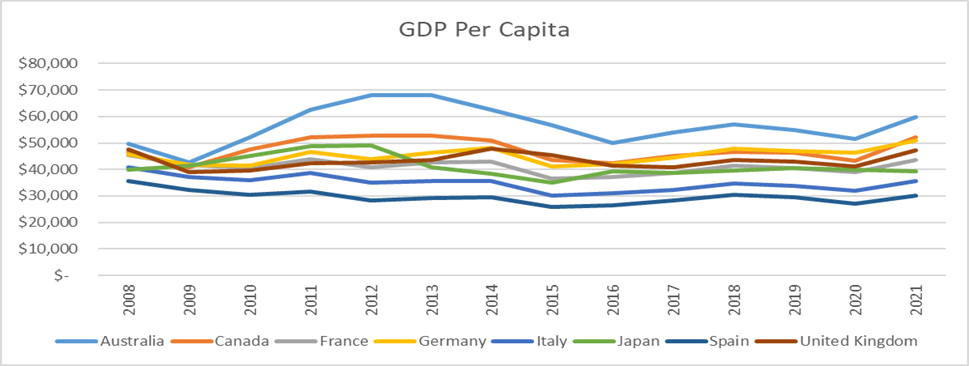

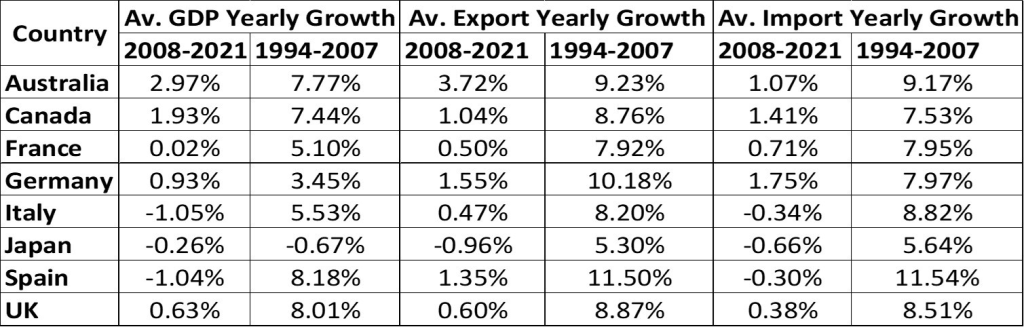

The dollar remains the dominant reserve currency of the world, and hence it is used as a common denominator to compare the economic metrics of different countries with different currencies. Observing the $ Nominal GDP and the $ GDP per capita, there is a flattening of the growth. Compared to the prior 14 years, the growth in both these metrics has significantly declined. People have been feeling the effects in their day-to-day life. Compared to the roaring 90s and the early 2000s, when people saw their lives improve significantly, that has not been the case over the last 14 years.

Another metric that one can see is the exports and imports, where there is also a significant decline in the average yearly growth rate for the period of 2008-2021 compared to 1994-2007 for all eight countries. Some countries such as Italy, Japan, and Spain have seen negative growth rates. Other countries have a marginal growth rate. Compared to many emerging markets during this period, these eight countries have largely plateaued. Import-Export is not only a measure of production inside a country but also a measure of influence that an economy can have on a global stage. Germany, a global export powerhouse, has seen its first current account deficit in decades owing to a decline in exports to its major export partner China and soaring energy prices.

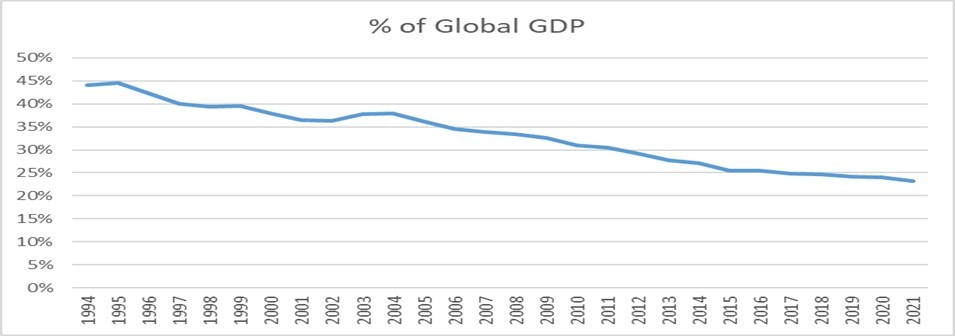

Over the last 14 years, due to two recessions in 2008 and 2020, these countries took significant debt and have still stagnated with marginal growth. A debt-fueled growth is always unsustainable. The massive stimulus packages have resulted in an unprecedented increase in debt for these countries. These economies have still not recovered from their decline. Compared to the world, these economies constituted around half of the global GDP in 1994 (44%), and now their share in the world GDP is 23%. The decline accelerated after 2008.

As we move into the second half of 2022, the world is facing new challenges, from record high inflation, supply chain issues, increasing interest rates, the war in Ukraine, and high energy prices to declining GDP. The current recession would have long-term effects, as it did in 2008. What is worrying for these economies is that they have used their reserves and are now highly in debt, making the situation even more precarious as they navigate towards the next recession.

Emerging economies in Asia have significantly increased their share of the world GDP. As the world settles into a new economic reality, the past leader would be replaced by new leaders and create new opportunities in new parts of the world, making the world’s new economic order.