The US military has proved its dominance across the globe since World War 1. The world’s largest economy, the US has outperformed its adversaries and preserved its economic and military leadership on the world stage. The US spent $727 Billion on the Department of Defense in 2022, about three times China’s and ten times India’s military budget. With new geopolitical challenges emerging across spheres, can the US maintain spending such large amounts in the next decades, and at what cost to the American taxpayers?

Before we get into the numbers, we need to understand the concept of cash and accrual-based accounting. In cash accounting, we simply record the cash spent in each period and account for that as the expenditure. In accrual-based accounting, we record the expenditure incurred, regardless of the actual cash paid for that expense in that period. For example, a person gets an electricity bill for $100 on January 1st but the cash is paid on 15th January. In cash accounting, they would record all the costs on January 15th. In accrual-based accounting, they would record the cost on January 1st when the bill was received.

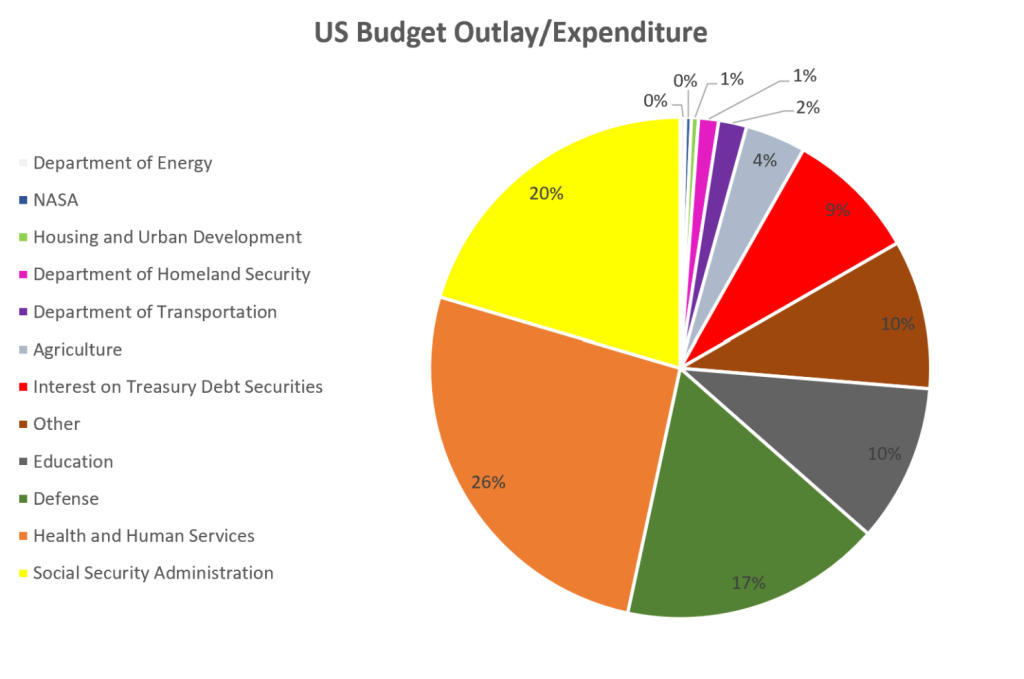

As you can see the disadvantage of cash accounting is that there can be a delay in recording the costs that occurred in the past. The general discussion about budgeting is around cash-based accounting. The US spent $727 Billion (cash/outlay) on the Department of Defense last year (Oct 2021 – Sep 2022). But there are other line items in the budget such as the Department of Veterans Affairs, $274 Billion, and Defense Civil Programs $57 Billion. The combined total expenditure on Defense is a staggering $1,058 Billion, 17% of the total budget outlays for the government (Figure 1). Analyses of the budgetary allocations leave very little room for other important sectors such as infrastructure, energy security, healthcare, border security, and police.

Figure 1: Data From https://fiscaldata.treasury.gov

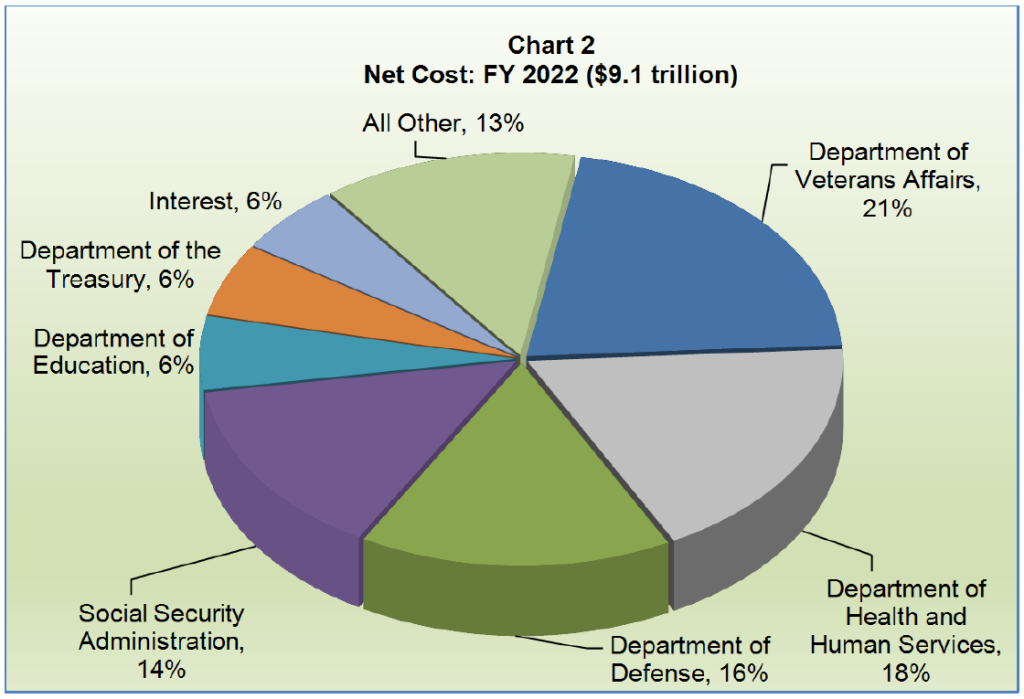

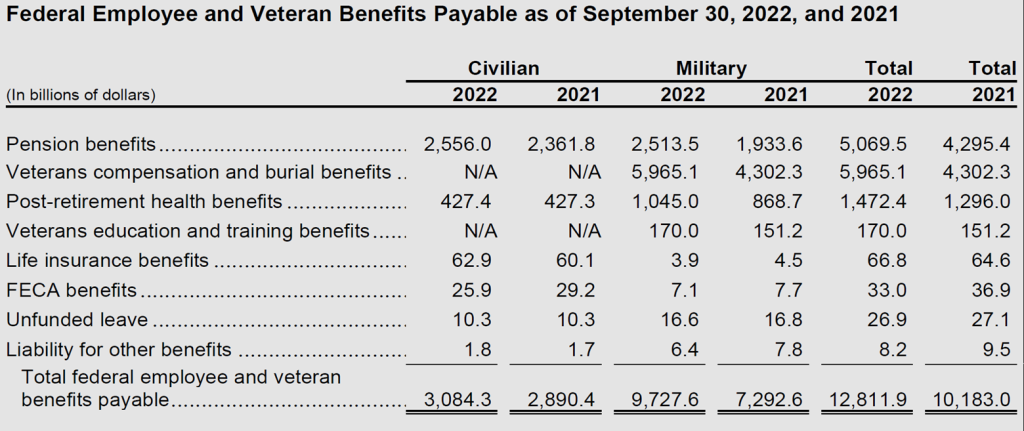

This is a blurred picture, as we look at the accrual-based costs in Figure 2, the cost of defense share is 37% i.e., $3.4 Trillion, a value so great it is more than the GDP of 95% of the countries of the world. In addition to this, the total liabilities, Military Veteran Benefits to the US government that it would have to pay in the next few decades is, an ever-increasing $9.7 Trillion (Figure 3).

Figure 2: Chart from The US government Financial Report FY 22

The liability comprises the health and life insurance, pensions, education as well as other benefits that the government offers its veterans. Most of these liabilities would be paid in cash in the future, hence giving a false sense that the costs are lower in the current period.

The liabilities are increasing over the years largely due to changes in benefits program experience and assumptions such as interest rates, beneficiary eligibility, increasing life expectancy, decreasing mortality rates, and increasing medical costs. Part of these liabilities are from the troops surge that the US had from Iraq and Afghanistan wars, the financial impact would be felt for decades to come.

Figure 3: Table from The US government Financial Report FY 22

As the US hits its debt ceiling of $31 Trillion this year, the US congress is discussing a plan to cut budget spending and the budget deficit of $1.4 Trillion, military spending would be one of the top priorities for discussion. With new emerging challenges both domestic and international, the US government would need to reevaluate its budgetary priorities and its engagements across the globe. Additional foreign military engagement would have an overwhelming financial impact on the domestic budget obligations for the government as well as an impact to maintain global superpower status.